With AFAS Payroll & HRM software, you automate important HR & Payroll tasks so that your colleagues spend less time on administrative work. With more than 10 years’ experience as an AFAS partner, our HR & Payroll consultants keep a close eye on the software.

In this article, they select the most useful new features from AFAS, specifically for HR & Payroll professionals. That way, you will know whether you are missing out on any optimisation opportunities.

The highlights from Profit 22 for HR & Payroll

In December 2022, the rollout of AFAS Profit 22 began. Even though it is a minor update, there are two important highlights for HR & Payroll that we don’t want to keep from you.

1. WAZO message paid parental leave

Since 2 August 2022, working parents can take paid parental leave. During this leave, the UWV will continue to pay part of the salary. This is done via a WAZO (pregnancy and childbirth benefit) benefit and amounts to 70% of the daily wage. After the parent has taken the leave, this benefit is applied for by the employer from the UWV via a WAZO application.

Through Profit 22, when a child is born, you can easily declare the benefit to the UWV digitally in Profit. So there is no need to go to the UWV employer portal for this.

You can do this in AFAS Profit 22 via HRM – Presence and absence – UWV-digitaal – Parental leave declaration.

You can submit one WAZO application per child. You need to have already set up the Digital delivery to UWV functionality and the UWV-digitaal authorisation menu item for this. Additional set-up may be required, depending on the current set-up. Salure can help you with this.

In addition, AFAS provides a number of signals that allow you to track the progress of taking parental leave and send out WAZO applications on time.

2. CSR dashboard

AFAS already offers several HR analytics dashboards. Through Profit 22, an important new dashboard will be added: the CSR dashboard.

From 1 January 2024, employers will have to report on their impact on people and the environment. This is set out in the CSRD directive, adopted by the European Union in 2022. Its aim is to make corporate sustainability information better and more transparent.

With Profit 22, AFAS is taking an important step in the field of CSR with the new CSR dashboard. This dashboard provides insight into your organisation’s energy consumption and CO2 emissions.

When setting this up, you set a certain CO2 emission per unit (e.g. per cubic metre of gas or per kWh of electricity). You can then manually book or import the consumption and delivery of energy. Based on this, the total CO2 emissions are calculated.

Want to get started with Profit 22?

Want to get started with Profit 22 and test the new version? Our team of AFAS specialists is ready for you with a handy test script! Contact us for more information.

About AFAS HRM and AFAS Payroll

AFAS’ HRM software streamlines all your HR and payroll processes with one system. Most people who work with AFAS are familiar with the AFAS InSite component. This is AFAS’s online employee portal.

ESS and MSS in AFAS InSite

Through the Employee Self Service (ESS) in AFAS InSite, employees can, for example, request their leave, view their payslips or enter claims. Via the Manager Self Service (MSS) in AFAS InSite, managers can then approve the requests and claims. In many cases, this can even be done very easily via the AFAS Pocket App.

What is AFAS Profit?

AFAS Profit is AFAS’ underlying software. It stores all data and saves the set-up of AFAS InSite. AFAS Payroll, AFAS’ payroll software, is part of this.

With AFAS Profit, you build workflows linked to actions of AFAS InSite. For instance, what needs to happen when someone calls in sick? AFAS Profit is used by employees who manage and set up the software or need to view HR data, such as the administrator, HR manager or payroll specialist.

Wondering whether you missed any optimisation opportunities in the previous release? Here are the highlights for HR & Payroll from the previous major Profit updates:

Our favourites from Profit 21

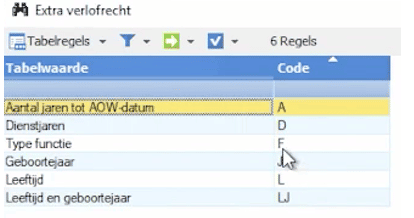

1. Expanding leave entitlements

In Profit 21, the options for automatically granting leave entitlements have been expanded. Earlier, you could grant additional leave entitlements based on age, years of service and job type. For example, you could grant extra leave days to an employee with a heavy job profile and a certain age. In Profit 21, a number of fields have been added to this:

The reference points for leave entitlements have also been extended. You can have leave entitlements start on the day of the reference moment itself (instead of the 1st of the month). So, for example, on the birthday or the day on which the number of years before the state pension date is reached. This way, you need to make fewer leave adjustments and set up fewer employment conditions.

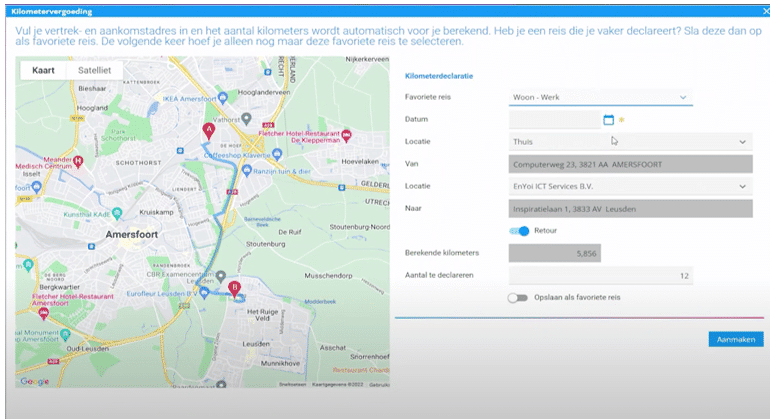

2. Frequent travel

Do you employ employees who often make the same journey, for example to a regular customer? Then there is good news! Because entering a mileage claim is now a lot faster.

This is because in Profit 21, you can add a favourite trip. This way, the addresses and travel distance are automatically entered and calculated correctly:

Make sure you use the Google Maps calculation here.

Employees can create and maintain a favourite trip themselves via the claims portal. You can set the addresses of the various locations at employer level in the location table. This way, the addresses are filled in automatically when the employee submits a travel expense claim.

An additional field for travel date has been added, in addition to the submission date that already existed. Based on that travel date, you can see whether a trip is being declared twice. This means managers get more control over travel expense claims, and the employee saves a lot of time.

3. Spend less time on temporary and future changes

Is an employee getting a temporary new position or schedule change, or going on parental leave? Then the next update will save the HR department a lot of time. In Profit 21, you only need to enter one change for this instead of two, and only when the change takes effect. From now on, before the end date of the change, you will receive a signal asking whether you want the temporary change:

- finish, that means the change ends automatically as planned;

- adjust, e.g. to extend the change;

- structural, if the temporary change is to become permanent.

So you no longer need to enter a new change when a temporary change comes to an end.

Note: in the context, check the “temporary” box and enter in the change date so that the signal goes off properly. You can also attach a document here with digital signature, if needed.

So you have more control and less worry about temporary changes, thanks to automatic signalling before the end date. This is especially convenient for paid parental leave: you can quickly specify at the right time whether you want to stop or extend paid parental leave. That saves a lot of time!

4. Redefine conditions in the workflow

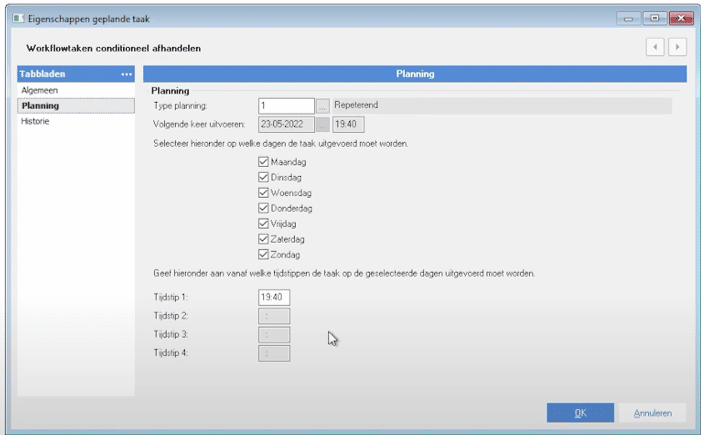

This is a pleasant Profit 21 update that saves HRM administrators a lot of time. It is now possible to redefine workflow conditions once a day: i.e. not just when the workflow enters a task. This prevents worfklows from stalling when a certain condition is not met.

Example

Consider a rejected claim from an employee who has left service. Instead of this task sticking with the ex-employee, you can automatically forward the workflow to payroll through a condition. By setting these conditions on a daily basis, workflows run better and you need to do a lot less manual work on ‘floating’ workflows.

Scheduled tasks allow you to handle condition-based workflows automatically:

Our favourites from Profit 19

1. Enriching messages with sub-templates

In Profit 19, you can add data collection to a message template. So now you can add extra useful information that is not in the template by default. Employees see all the information at a glance, without having to click. For instance, you could send an overview with details of pending tasks. That way, colleagues can immediately see what they still need to do.

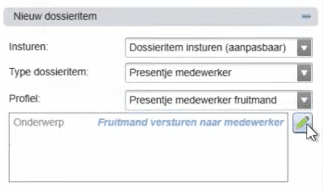

2. Starting profile from workflow or signal

It is now possible to start a profile from a workflow or signal. This update will save you a lot of time, as you can set up processes a lot more intuitively.

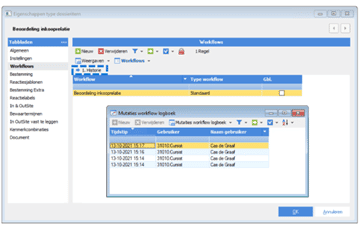

3. Logging on publishing workflow

Through Profit 19, it is possible to track the history of workflow publications. If you go to a dossier item and click on workflows, there is a History action button. This allows you to see who has edited the workflow and when. That makes it a lot easier to resolve errors after an adjustment.

Get the most out of AFAS Profit HRM & Payroll with Salure!

Do you have a question about the AFAS Payroll & HRM software? Or do you need help setting up the updates above? Contact our functional administrators via the Tickettool*. Our team of AFAS experts is happy to help you.

*The Tickettool is available to Salure customers with a Functional Management contract. Want to know more about this? Then please contact us via verkoop@salure.nl or call +31 182 543 643.