The wage tax statement or wage tax declaration form is used because, in most cases, your employer or benefits agency has to deduct wage taxes from your wages or benefits. Wage tax is a collective term in the Netherlands for income-related healthcare insurance contribution, wage tax/premium national insurance and employee insurance contributions.

What is the wage tax declaration form?

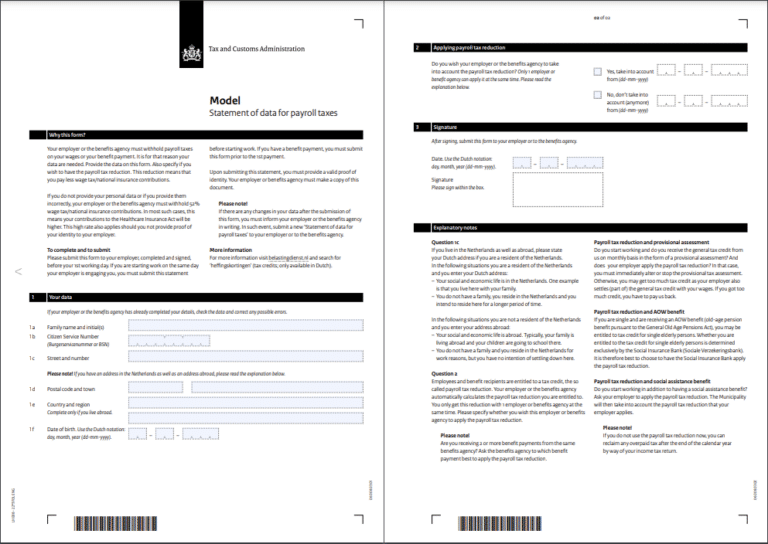

The wage tax declaration form is a form that employers or benefits agencies use to register your personal details for wage taxes. That is why you need to provide your details via this form called “Model Statement of data for payroll taxes.” On the form, you have the option to indicate whether your employer should apply the withholding allowance or not.

Why this wage tax form?

The wage tax declaration exists because your employer or benefits agency has to deduct wage taxes from your wages or benefits. In order to do this, they need your personal details.

It is important to indicate that you want withholding allowance. This is because you will pay less wage tax/national insurance contributions as a result.

The moment you fail to provide personal details or provide them incorrectly, your employer or benefits agency has to withhold 52% wage tax/ national insurance contributions. In addition, your Healthcare Insurance Act contribution will usually also be higher. The high rate also applies if you do not identify yourself to your employer.

Required details for wage tax declaration:

- Name and initial(s)

- CSN/citizen service number

- Street and house number

- Postal code and city

- Country and region (only applicable if you live abroad)

- Date of birth

- Phone number

- Date

- Signature

What is the best way to fill in the wage tax form?

The best way to fill in the wage tax declaration form is on a computer. The tax authorities cannot guarantee proper functioning of the form on a tablet or smartphone.

If you are unable to fill it in via computer, it’s best to save the form on your computer and try it that way. Does this not work? Then you can always print out the form and fill it in by hand.

Where do I submit it?

Submit the completed and signed form to your employer. Do this before your 1st working day. If you start work on the day you are hired, it is important that you hand in the declaration before you start work.

In case of benefit, you must submit this declaration completed and signed before the 1st payment.

The moment you hand in the form, you must show a valid identity document. This is because the employer or benefit agency must make a copy of it.

What should I do if my details have changed?

If your details change after submitting the form, you must first notify the relevant employer or benefits agency in writing. You then resubmit the form with the amended details to your employer or benefit agency.

Explanation of required details

What if I have both an address in the Netherlands and abroad?

If you live both in the Netherlands and abroad, you are supposed to provide the Dutch address if you are a resident of the Netherlands.

According to the tax authorities, you are a resident of the Netherlands in the following two situations and enter the Dutch address:

- Your social and economic life takes place in the Netherlands. For example, you live with your family here in the Netherlands.

- You don’t have a family, you live in the Netherlands and intend to stay here for a longer period of time.

In the following situations, you are not a resident of the Netherlands and must fill in the foreign address:

- Your social and economic life takes place abroad. This means, for example, that your family lives there and your children go to school in that country.

- You have no family and live in the Netherlands because of work, but do not intend to settle in the Netherlands.

Having withholding allowance applied with wage tax form

In the Netherlands, every employee and benefit recipient is entitled to a tax credit. We call this credit the withholding allowance. The credit that applies to you is automatically calculated by your employer or benefit agency.

You can only get the credit from 1 employer or benefit agency at a time. Therefore, you can indicate on the form whether you want this employer or benefit agency to apply the credit.

Note!

Do you receive 2 or more benefits from the same benefit agency? Then it’s smart to ask your benefit agency which benefit is best to have the withholding allowance applied to.

Withholding allowance and provisional assessment

Are you currently receiving the general withholding allowance monthly from the tax authorities in the form of a provisional assessment and are you going to work? And are you going to have the withholding allowance applied by your employer?

Then you should change or stop the provisional assessment immediately!

If you do not do this, there is a chance that you will receive too much withholding allowance, because your employer already deducts (part of) the general withholding allowance from your salary as well.

If you have received too much, you will have to pay the amount back to the tax authorities.

Withholding allowance and state pension benefit

Are you a single parent and receiving state pension benefits?

If so, chances are you are entitled to the single parent tax credit.

The Social Insurance Bank (SVB) is the one who determines whether you are entitled to the single parent discount.

In this case, it is best to have the withholding allowance applied by the SVB.

Withholding allowance and welfare benefits

What if I start working alongside my welfare benefit? Then you must ask your employer to apply the withholding allowance. The municipality will then take the withholding allowance applied by your employer into account.

Beware!

If you are not currently using the withholding allowance, there is a chance you will pay too much tax. You can reclaim any overpaid tax after the end of the calendar year through your income tax/national insurance contribution return.