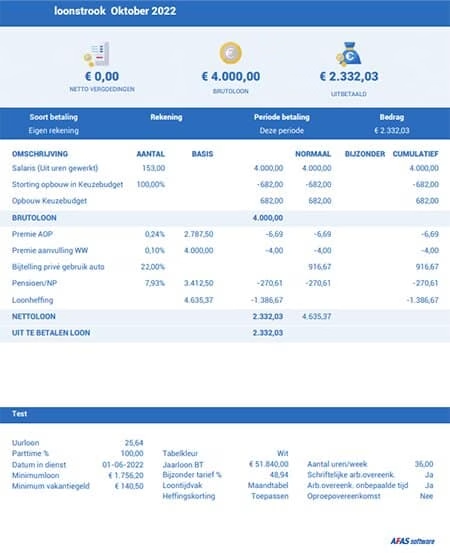

A payslip is an important part of payroll. Therefore, it is important to know what all the abbreviations and terms on it mean.

In this blog, we explain everything about the payslip: what it is, what all the abbreviations mean and what the terms on the payslip stand for.

What exactly is a payslip?

Salaried employees receive salaries. Employers are required to send a wage statement. This is the payslip. It shows what the employee earns: gross pay, net pay, holiday pay, any allowances and bonuses. In addition, the payslip shows what is withheld in terms of taxes and contributions. Depending on the work and the employer, the payslip also contains information about the pension and the individual elective budget.

In addition to this financial information, each payslip contains the details of the employee, employer and the period to which the payslip relates. If the employer uses AFAS, digital payslips are automatically sent and saved.

When does an employee get a payslip?

Employers can send the payslip digitally or on paper. Usually, a payslip accompanies every salary payment – monthly or every four weeks.

Incidentally, employers are not obliged to send a payslip every month. However, it is mandatory when the first salary is paid and if anything changes in terms of the salary or wage taxes.

Keep payslips or not?

Employees are not required to keep their payslips. Nevertheless, there is no harm in doing so, for instance to check whether the salary paid, the number of hours worked and any allowances are correct.

Employers do have a retention obligation. Payslips fall under basic data, according to the Tax Authorities, which requires companies to keep them for at least seven years.

Example of a payslip

How to read a payslip? Terms and abbreviations

There are many abbreviations and terms on a payslip. We explain how to read the payslip so you understand exactly what everything means.

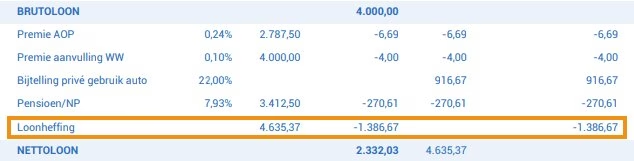

1. Gross wage

Gross wage is the whole amount the employee earns from the employer. Taxes and contributions are then deducted from this. Gross wage is therefore higher than the amount the employee eventually receives in his or her account. Official bodies such as mortgage lenders often calculate using the gross wage an employee receives. Most job advertisements also mention gross wage.

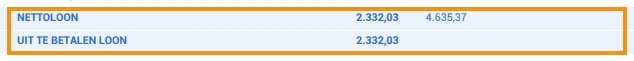

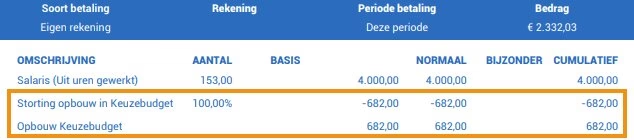

2. Net wage

This is the ‘clean’ amount the employee receives in their account. All taxes and contributions have been deducted from this.

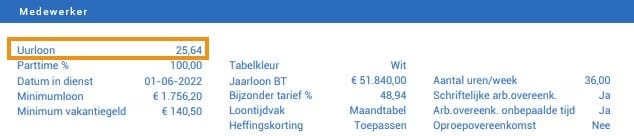

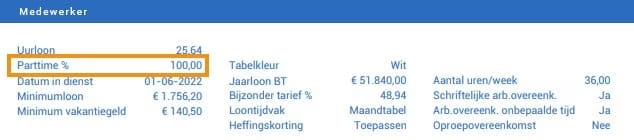

3. Hourly wage

This is the amount the employee earns gross per hour.

4. Part-time percentage

The part-time percentage indicates the percentage the employee works. How many hours means full-time varies by sector. Full-time is usually 36 or 40 hours.

5. Minimum wage

Every payslip shows the statutory minimum wage. This is the minimum gross hourly wage an employee must earn by law.

6. Table colour

The table colour determines the amount of wage tax. The table colour is white or green. White means wages from current employment. If the table colour is green, it is pay from previous employment, such as a transition allowance.

7. Special taxed wage

The Special Taxed Wage is the taxable annual salary for the previous year. This amount determines how much tax the employee pays this year on special remuneration such as overtime and holiday pay. The higher last year’s annual wage was, the higher the tax. The amount of tax is determined each year by the Tax Authorities.

8. Special rate %

This is the calculated tax rate on special remuneration.

9. Wage tax

Wage tax is the tax deducted from wages by the employer and paid to the Tax Authorities. Wage tax is the collective term for wage tax and national insurance contributions. The amount of wage tax is determined with wage tax tables set by the Tax Authorities.

10. Withholding allowance

This is the discount on tax and contributions. If an employee has several employers, he or she can get withholding allowance from one employer.

11. Holiday pay

This shows how much holiday pay the employee has accrued. Holiday pay is at least 8% of the employee’s salary. This amount is accrued during the year and paid out all at once. Most employers pay out holiday pay in May. In this example, holiday pay falls under the individual elective budget.

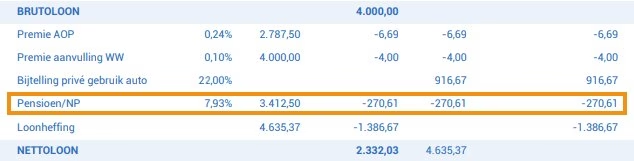

12. Pension

Both the employer and the employee themselves contribute to the employee’s pension. The pension contribution shown on the payslip is the employee’s contribution.

13. Net allowances

Are there additional net amounts on top of the salary? Then they are listed under this item. The remote work allowance is an example of such a net allowance

14. Individual elective budget (IKB)

If the employee has an individual elective budget (IKB), this is shown on the payslip. The employee can spend this amount as desired. For example, this amount can be paid out at the end of the year, or exchanged for additional leave.

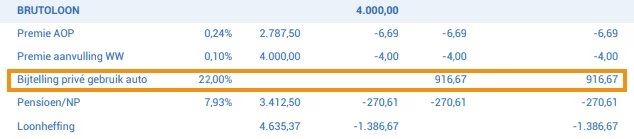

15. Additional taxable car benefit

This appears on the payslip if an employee has a company car and also uses it privately for more than 500 kilometres per year. The value of the private use of the car is added to the employee’s salary: this is the additional taxable benefit. The employee pays wage tax and contributions on the addition.

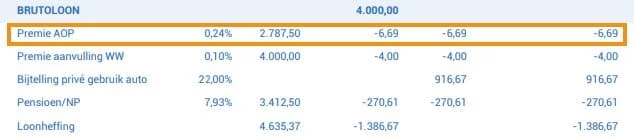

16. Pension contribution (AOP)

The abbreviation AOP stands for Arbeidsongeschiktheidspensioen (Occupational disability pension). The contribution is meant to supplement your income should you become disabled. The term can cause confusion, because the moment you become incapacitated for work, you will receive the amount even before your retirement age. This amount is to supplement your WIA benefit.